Lightning Pool Is Open for Business: Lease Liquidity, Earn Returns, Stack Sats

Today we're announcing the release of Lightning Pool, a non-custodial, peer-to-peer marketplace for Lightning node operators to buy and sell channels. Lightning Pool makes it easier to instantly accept Lightning payments, and opens up the new possibility of earning a yield on bitcoin by selling access to liquidity on Lightning.

This release marks an important development in the evolution of Lightning financial products, making Lightning liquidity a tradeable asset and enabling users to earn a return on their capital all while keeping custody of their funds.

With Pool, Lightning businesses and node operators can streamline their channel management and focus on building and serving their customers instead of worrying about liquidity. When node operators can more efficiently deploy their capital it improves the network as a whole, making it more reliable and resilient for everyone.

To get started, download the reference Go client, and check out the APIs for both gRPC and for REST. For those who prefer to get off the command line, we plan to ship a UI for Pool in the near future. And for a more extensive explanation on how Pool works, take a deep dive into our technical blog post and technical white paper.

Learning How to Swim: Why Pool

Since lnd’s mainnet launch in 2018, we’ve heard about the pain points developers and node operators on Lightning were experiencing. The most important of these is that inbound liquidity is a scarce resource that takes time and skill to efficiently allocate.

We heard this from non-custodial wallets like Zap, merchant services like OpenNode, and even exchanges like Bitfinex. In absence of a reliable source for easily acquiring inbound liquidity, network participants began developing ways to meet the demand on their own:

- Bitfinex and other well-capitalized nodes periodically take requests from users who want channels opened to them.

- Node operators have created Telegram groups offering mutually balanced channel opens, and posted on Twitter looking for channels.

- Numerous OTC services for purchasing inbound liquidity have emerged, such as Bitrefill selling inbound capacity directly, LNBig charging for channels (the first one is free!), and PeerNode offering a request for channels where nodes have to apply.

The advent of these solutions serves as confirmation that there is increasing market demand for liquidity providers. The most scalable way to meet this demand is a deep, two-sided marketplace for buyers and sellers. Lightning Pool is just that.

Welcome to the Pool Party: Problem Solved

Popular Lightning services like Strike have already encountered surges of demand that required them to quickly open channels in order to onboard new customers. Using Pool, node operators can now be paid for opening up new channels and providing inbound liquidity. This opens the door to new sources of revenue for leasing out liquidity and deploying capital on Lightning.

Further, non-custodial wallets like Breez are required to act as the first hop for their users in order to guarantee excellent UX. Several of these companies have mentioned wishing to offer users a “marketplace of nodes” instead. Pool serves as this marketplace so that wallets can safely connect their users with highly rated routing nodes, allowing them to focus on improving UX instead of liquidity management.

Pool provides an even greater benefit for new participants such as merchants and Lightning developers bootstrapping their liquidity when they first join the network. To date, new nodes have no way of knowing where to place their valuable capital, and no way to signal their need for inbound liquidity. Currently, the best method is to pick nodes in an ad hoc manner from leaderboards like 1ml.com, and learn over time. With Pool, however, new nodes can now simply put their capital up for bid in the Pool marketplace (and also bid on new inbound for themselves), and trust the market forces will direct their liquidity to where it’s most needed.

For Lightning as a whole, Pool provides a benchmark rate of return against which nodes can make economic calculations. By design, routing nodes don’t know how much volume their peers are routing, so they haven’t had good ways to measure if their capital is allocated efficiently. Pool solves this problem with pricing signals, bringing nodes out of the dark by showing when and where the market is demanding liquidity.

To Infinity Pool, and Beyond!

Over the last few weeks, participants in our closed mainnet alpha have been earning a yield on real bitcoin without trusting a third party, as Pool uses the bitcoin blockchain as its clearing and security layer. Their channels sold through Pool have been transformed into brand new bitcoin-native yield-bearing assets. In these early days, Pool channels will have a fixed two-week duration, but as Pool matures we plan to add additional markets with other durations.

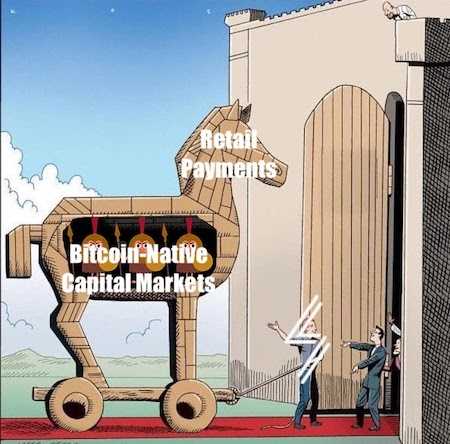

Plotting the projected yields from these different channel durations will produce a yield curve. In traditional finance, yield curves for US Treasuries provide benchmark rates of return upon which the rest of the world’s capital markets are built. Fully developed liquidity markets in Pool will provide the same utility, but for nascent bitcoin-native capital markets instead.

Dive In: Try the Mainnet Alpha Today

We invite you to try out Pool whether you’re a merchant receiving funds, a power user looking to deploy additional capital on Lightning, or anything in between.

With today’s mainnet alpha release, Lightning Pool is now open to any user running an active routing node. To ensure a good experience, the alpha version by default matches liquidity purchasers only with well-connected nodes as measured by our Bos Score rating system. If you are not on the Bos Score List but run an active routing node, please contact us to get started. To learn more about the Pool fee structure, check out our product page.

Pool is now available via the command line using the reference Go client and also in Lightning Terminal with the LiT v0.3.0 release (UI coming soon!). APIs are available for gRPC and REST integrations. As always, we want to hear from our community, so please email us or join our community Slack to let us know what you think, get help, or ask questions about diving into Pool.

This release has been a long time in the making—we are excited to ship a product that solves the liquidity problem and creates a new avenue for #stackingsats. Here’s to the real future of finance! ₿🥂🍻

Download the Whitepaper (PDF)