Taproot Assets on Lightning: The Global Financial Interoperability Layer ⚡💱

Today we're excited to announce the release of Taproot Assets on Lightning, the first multi-asset Lightning protocol on mainnet. With this release, assets can be minted on bitcoin and sent via the Lightning Network instantly for low fees. As such, we now have the ability to make bitcoin and Lightning multi-asset networks in a scalable manner anchored in bitcoin's security and decentralization. This step forward will give users access to the world's currencies on an open, interoperable payments network while routing through bitcoin liquidity, making bitcoin the global routing network for the internet of money. Together we are bitcoinizing the dollar, and the world's financial assets.

We are incredibly grateful to the bitcoin and Lightning developer community for their support in providing feedback on the protocol, testing early versions of the software, and building the initial products for end users. These early adopters have continuously iterated with our team over the last several months of development, minting over 170,000 assets on-chain, building wallets, exchanges, explorers for universes, which are a repository holding all the information needed for a wallet to initialize and download the state of a specific Taproot Asset, and more. Builders can now move from on-chain development to giving their users access to assets on a global, low fee payments network with Lightning, which will greatly improve user experience and the variety of applications that developers can build. We're excited to see all of the new possibilities coming out of this release.

With the design of the Taproot Assets protocol, instead of each asset issuer needing to bootstrap their own sub-network of liquidity and routing nodes, all issuers can leverage the existing network effects of the 5,400 bitcoin allocated to the Lightning Network. With Taproot Assets on Lightning, assets route through bitcoin, serving as a global routing currency. We believe the ability to re-use existing bitcoin liquidity and make use of existing routing nodes will allow for rapid adoption of Taproot Assets. In practical terms, with multi-asset Lightning features now available, developers can open Lightning channels denominated in a unit of account of their choice that can natively interoperate with the rest of today's Lightning Network. In particular, we are excited to start seeing stablecoins issued and integrated across the many wallets, exchanges, and payment providers live on the network today. The global demand for stablecoins is undeniable, especially in emerging markets. With Taproot Assets, these users will get access to the Lightning ecosystem for improved speed, security, and UX.

Harnessing the Geopolitical Significance of Stablecoins to Bring Bitcoin to Billions

Lightning already functions as an interoperability layer for global exchanges, wallets, and merchants. Bitcoin developers are also using it to financially unify new ideas like Chaumian ecash mints, sidechains, and other off-chain projects. A multi-asset Lightning Network dramatically expands the number of developers and companies that will make use of this interoperability layer by allowing stablecoin users to transact with Lightning's instant settlement, low fees, and global reach.

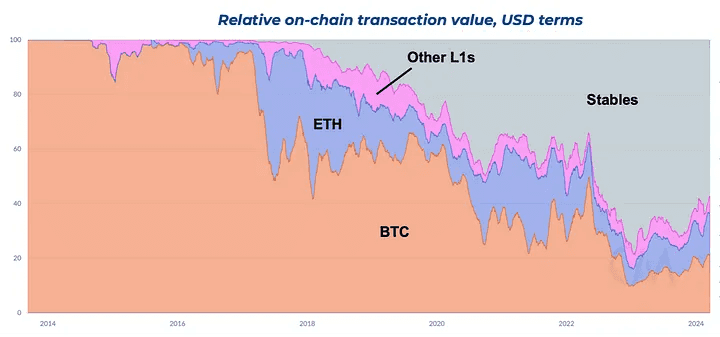

Stablecoins have exploded in popularity over the last five years, now accounting for over half of the relative global on-chain transaction value in USD terms according to Nic Carter at Castle Island. According to K33 Research, annual stablecoin volume was $11T in 2023, and they project it to cross $30T in 2024, more than double Visa's annual volume. This growth has made stablecoins geopolitically significant as evidenced by the former US Speaker of the House promoting stablecoins as a solution to the US debt crisis, stablecoin issuers holding more treasuries than Germany and South Korea, with Tether stating that they're one of the world's top three holders of short term US debt, and an estimated 4% of Turkey's GDP being used to purchase stablecoins. At the time of our last major release in October 2023, fiat-backed stablecoins totaled $115B of issuance. Today, there are $148B of fiat-backed stablecoins in circulation, representing 46% annualized growth (with USDT experiencing the majority of growth). At the current rate of growth, total stablecoin issuance will cross $1T in ~2030, and it may well accelerate.

This demand is primarily driven by users in Asia, the Middle East, Africa, South and Central America, "all regions of the world that have difficulty accessing the banking system," according to Tether CEO Paolo Ardoino. Financial institutions around the world are connecting to the networks these users leverage to service their demand. Onboarding those users and their financial institutions to bitcoin infrastructure via Taproot Assets is vitally important both for ensuring the security of their operations, and scaling usage of both bitcoin the asset and bitcoin the network to the world.

In a world with $1T of total stablecoin issuance, the multi-asset Lightning Network will connect exchanges, wallets, and merchants with forward-thinking neobanks, mobile money providers, institutional market makers, and every other financial institution on the planet. It will be well on its way to becoming the world's default value transfer network, disrupting decades-old legacy networks like VISA, Mastercard, SWIFT, and more. And thanks to the Taproot Assets design, every transaction across this network will use bitcoin as the global routing currency.

Build the Future with the New Taproot Assets v0.4

For developers building today, with this release, they can access the full suite of Lightning functionality for Taproot Assets: opening/closing channels, making instant, low-fee payments, atomically swapping assets for bitcoin, forwarding Taproot Assets Lightning payments, and more. It also provides an enhanced feature set for on-chain operations.

This Lightning-enabled Taproot Assets release is available in the most recent Polar release, a popular tool for rapid prototyping amongst application developers. To get started with the Taproot Assets daemon: read the Install section, download the daemon release, review the API documentation, and read the getting started guide. Note that while this release supports mainnet, the alpha tag indicates that we advocate the community to be measured in its deployment. These cutting-edge features and integrations are relatively new to real-world testing and may not yet be ready for production-deployment mainnet use at scale. We encourage developers to experiment with these new capabilities with caution.

For a more extensive explanation on how Taproot Assets works, take a deep dive into our documentation.

Multi-Asset Lightning on Mainnet ⚡

First, as demoed by Lightning Labs CTO Laolu Osuntokun (aka roasbeef), this latest release includes all the functionality needed for multi-hop Taproot Assets payments routed across the Lightning Network through bitcoin. Specifically, APIs for opening Taproot Assets channels, generating asset invoices, and paying asset invoices have been included. To maximize the ability for applications to adopt Taproot Assets in a rapid yet secure manner, first-class support for these new APIs has been integrated seamlessly into the existing developer-friendly litd bundle, which includes lnd, tapd, loopd, and more running as a single binary. By running this bundle, developers are able to use Taproot Assets with the exact same APIs they are familiar with, but including new asset-related parameters.

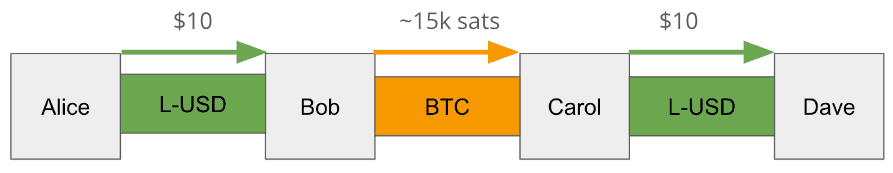

One new capability, introduced with the Taproot Assets Lightning integration, is the ability for edge nodes, which are routing nodes that bridge Taproot Assets users with the broader Lightning Network, to negotiate rates for atomic swaps between Taproot Assets and bitcoin while forwarding payments. This release includes the Request for Quote (RFQ) service, which involves the generator of a Taproot Assets invoice pinging their Taproot Assets liquidity-providing edge node(s) for a time-limited price quote between the asset in question and bitcoin. The edge node can acquire that quote from their own order book if they run an exchange, or from a collection of exchange APIs if not, and the receiver can either accept the quote or decline it if it's unfavorable and request a new one. Once a quote has been accepted, the edge node cryptographically signs it and includes it in the invoice in a way that makes it indistinguishable from any normal invoice. As a result, the sender only sees the exchange quote as a standard Bolt 11 routing fee, which extends the ability to pay Taproot Assets invoices to any Lightning wallet, with no knowledge of Taproot Assets required.

As shown above, Dave who is the receiver of the asset generates the Taproots Assets invoice. In order to do so, Dave needs to first agree to a rate with an edge node providing liquidity to his node. If Dave declines an initial quoted price, he can try to get alternative quotes through other Taproot Assets edge nodes. Similar to routing nodes on the Lightning Network, there will be competition between edge node operators to provide efficient pricing and payment reliability. Once Dave agrees to the quoted price, he generates the invoice and provides it to Alice, who sends the payment. Ultimately, this process will be handled automatically through node configuration and wallet UX.

Trustless On-Chain Swaps 💱

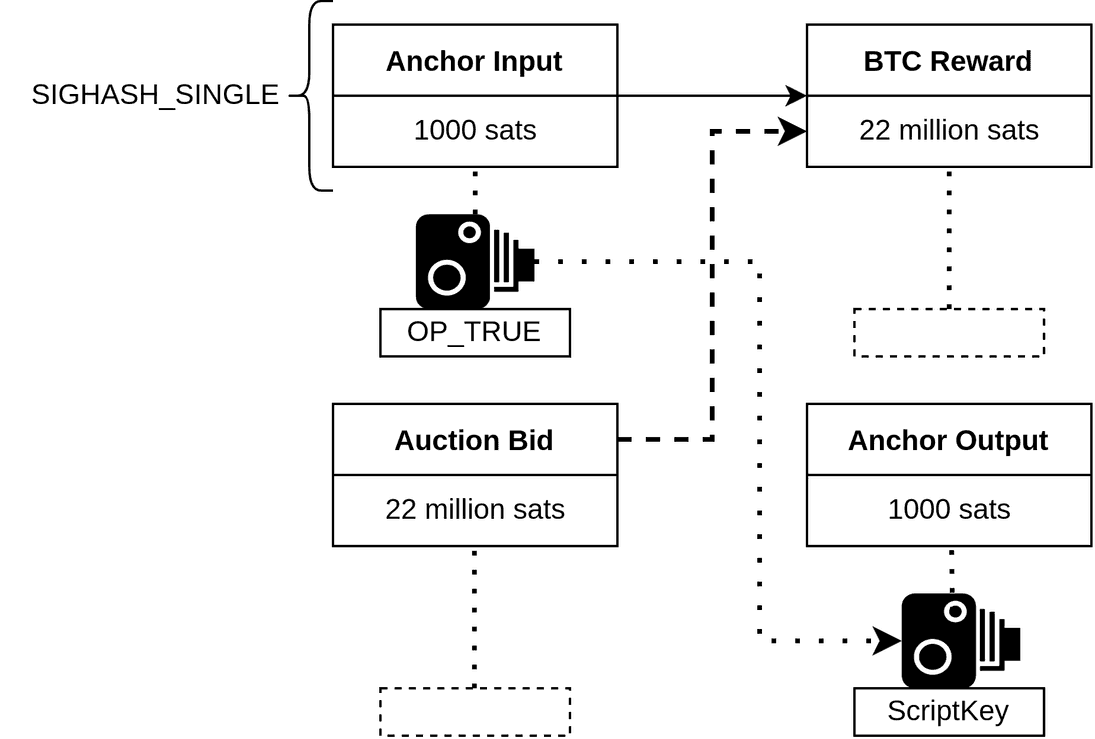

In addition to the Lightning functionality in this release, we are also introducing trustless, non-custodial, on-chain swaps. With this feature, Taproot Assets users and developers can atomically swap assets for bitcoin or other Taproot Assets via Partially Signed Bitcoin Transactions (PSBTs), allowing users to trade non-interactively in a chain-efficient manner, and without requiring trust of their counterparty or a centralized coordinator.

To initiate a trustless, on-chain Taproot Assets swap, the seller starts by creating a PSBT that proves their ownership over the asset while also allowing their counterparty to claim ownership over the completed PSBT (leveraging the SIGHASH_NONE sighash flag on the taproot assets layer). They specify the asset to be swapped as the transaction's input, and then stipulate the asset to be purchased as the transaction's output (in BTC in the above example). At this point, the transaction will not pass validation because the transaction inputs insufficiently fulfill the outputs. To make the PSBT valid and claim the asset, the prospective counterparty will need to add an input with assets matching the output required by the seller (22M sats in the attached example). In the case of multiple potential counterparties, only the buyer whose transaction gets included in a mined block can claim the asset, with other competing bids becoming invalid once the winning transaction is confirmed on-chain.

This non-interactive, atomic, and decentralized method of exchange is achieved by the unique design of Taproot Assets, introducing a new design space for application developers. With this feature, it's now possible to build peer-to-peer exchanges with Taproot Assets and we can't wait to see what developers build with it.

First-Class Multi-Sig Support for More Advanced Ownership Solutions 🔐

Security is at the core of bitcoin's foundation. With that in mind, issuers, custodians, and developers have all mentioned the importance of securing Taproot Assets with bitcoin-level assurances. In response to this feedback, this release includes first-class multi-sig support for advanced custody options at every layer of Taproot Asset ownership. Users will also be able to back up time-locked cold keys in the event their hot keys are destroyed. Now Taproot Assets owners can customize exactly how their holdings are secured, and incorporate them into existing bitcoin multi-sig products. This addition will allow for the developer and issuer community to build with security at the forefront using existing, familiar methodologies.

Secure Asset Issuance in Multiple Tranches ⏩

Taproot Assets provides native support for assets issued in multiple tranches (e.g. stablecoins) wherein the tranches are intended to be fungible. While all the assets minted in an individual tranche are identified by an asset_id, all tranches of a given asset share a group_key identifier, providing provenance verification and asset fungibility. The latest feature enhancement for group_key assets brings scripting functionality during the minting process. Issuers are now empowered with the ability to require a multi-sig threshold before minting, or to programmatically rate limit how much of an asset is issued, improving their ability to secure the issuance process. And for asset issuers and developers running a Universe server, we've added new features that enhance efficiency and minimize the operational burden.

Integrate Taproot Assets on Lightning Today

Now is the time for developers to start building new applications and use cases with a multi-asset Lightning Network. We are excited to see new and existing Lightning wallets add stablecoin support for emerging markets users, new Lightning-based exchanges for instant Taproot Assets swaps, institutional Taproot Assets custody solutions using the new multi-sig features, and solutions for edge node operators to help them manage risk and maximize profitability. No other network offers the speed, payment breadth, and modern UX of multi-asset Lightning, and an entirely new ecosystem to serve these needs will be created by the next wave of entrepreneurs.

To get started building with Taproot Assets on Lightning, developers should download the latest version of the litd suite and use it in integrated mode. The litd bundle combines lnd, tapd, and a number of liquidity services into a single binary, providing the most straightforward way to integrate multi-asset Lightning.

Join the Taproot Assets Developer Community!

It's been amazing to see the bitcoin developer community build new experiences with Taproot Assets. Lightning functionality, in addition to the new trustless swap and multi-sig features, will allow them to expand their offerings and attract even more users. Joltz Rewards, Speed, Lnfi Network, Royllo, Tiramisu Wallet, Megalithic, Flash Protocol, UXUY, TNA, Bittap, and many more are collectively building the Taproot Assets ecosystem of web wallets, mobile wallets, open source SDKs, asset explorers, developer tools, and Nostr integrations -- with more coming every day! The developer enthusiasm to start building with Taproot Assets is infectious, and with Lightning support now available we expect to see the number of Taproot Assets applications expand rapidly.

Want to get started exploring Taproot Assets? Download the release, check out the API docs, and read the getting started guide. For a deeper technical explanation of Taproot Assets, dig into our developer documentation, or check out our Tapping into Taproot Assets series on Youtube. Want to get involved further? Join our Slack community, follow us on Twitter, attend the Taproot Assets Community Calls, contribute a PR, or subscribe to our newsletter!